Strategy in AI’s Shifting Sands: Part 4 – A Venture Framework for MENA Value Creation

The global AI landscape is evolving at breakneck speed. Almost every week, new market maps appear, only to become outdated just as quickly. We’ve all witnessed how generative AI has moved from a novelty to a mainstream catalyst, promising to upend long standing paradigms in software, services, and beyond. However, as early-stage, regionally focused investors, BECO Capital applies a disciplined lens to where and how we invest in AI. Not every space or stage aligns with our remit, particularly those requiring massive capital injections (such as AI infrastructure or specialized hardware). Instead, we concentrate on what we do best: identifying opportunities that can quickly benefit from operating leverage where we can help founders validate their products locally and then quickly scale globally once product-market fit is achieved.

Refining Our Focus: Beyond Infrastructure

When most people think of AI, they envision large foundational models, high-performance computing, or physical infrastructure, such as advanced cooling technologies for data centers.

While these areas may be attractive to growth and later-stage investors, they are less suited to our early-stage strategy. Foundational AI and infrastructure plays typically require significant capital, face intense competition, and often come with lofty valuations. There are certain opportunities we have been evaluating in infrastructure that are asset light and can quickly scale, although these are one offs and don’t underpin our overall theses.

The recent shake-up of the AI space (credit to Deepseek) has prompted many builders to reconsider the fundamental “hows” and “whys” behind what they are creating. For founders developing products reliant on LLMs, this moment is akin to winning the lottery. The rapid cost reductions driven by Wright’s Law (efficiency gains with scale), Moore’s Law (hardware advancements), and the Experience Curve (software and inference optimizations) are transforming AI economics. As LLMs continue their deflationary trajectory, model usage is becoming significantly cheaper. This improves margins for companies that have historically spent heavily on compute, while also pressuring closed-source providers to lower costs and potentially open-source their models.

We continue to believe in a hybrid future where open and closed source AI co-exist. However, for our fund size of $120 million, foundational AI and infrastructure investments fall outside our scope – unless they buck the trend of capital intensiveness. Additionally, the regional market lacks the demand (outside of government), ecosystem maturity, and activity level necessary to sustain such capital-intensive ventures. The substantial funding requirements and extended timelines make them better suited for alternative financing models or larger, more developed markets.

Instead, we focus on companies solving clear pain points and leveraging AI to enhance customer outcomes. Much like the internet, AI will inevitably permeate every industry, and the most enduring solutions will come from startups with strong technical talent or proprietary data that enable them to wield AI effectively.

Our value lies in helping founders secure early customers, forge marquee partnerships, attract top tier talent, and build momentum, both regionally and beyond. Through our strong global network of AI specialists and leading venture capital funds, we provide founders with the insights, capital, and strategic guidance they need from smart money investors. This approach not only bridges the gap for emerging AI startups but also creates clear pathways for scaling into larger global markets.

By prioritizing application-level software, user-centric products, and specialized AI-enhanced services, we align with opportunities that are sustainable and capable of delivering venture-scale returns.

First Mover Advantage or Disadvantage?

A phenomenon has emerged in the AI world: the perceived first-mover “advantage” can quickly become a disadvantage.

Generative AI has rapidly become a focal point of the hype cycle, driven by a fear of missing out on the latest trend. However, the very nature of this fast-moving industry often undermines long-term defensibility. Switching costs are typically low, as users can easily migrate to newer, superior applications, and foundational models are frequently outpaced by rapid advancements. While generative AI has undeniable potential, many companies struggle to sustain their competitive edge in the face of relentless innovation and minimal barriers to entry. For now, we have witnessed many global companies that have managed to scale from single digit millions in revenue to tens of millions in revenue in a matter of months – something to keep an eye on in terms of future continued velocity.

BECO Thesis

1. Speed and Solutions Beat AI Moats

Defensibility in generative AI is difficult to achieve. In our view, no single moat exists, true defensibility comes from multiple layers that, when combined, create a sustainable advantage.

Questions like “How defensible is what you’re building?” or “What’s your moat?” are often difficult to answer and, frankly, overly simplistic. Defensibility is far more complex and dynamic. Instead, we focus on two core areas:

First, we look at companies that aim to own the value chain, whether through processing power, foundational model innovation (which is becoming increasingly difficult), or network effects. This approach demands significant capital to establish scale-driven barriers and market dominance.

Second, we prioritize businesses with clear value propositions that leverage proprietary data to solve specific, high-impact problems and demonstrate early signs of retention. These companies embed AI deeply into workflows, creating operational reliance and higher switching costs. Regardless of the approach, the defining factor is speed, how fast founders build, iterate, and sprint forward. Success in AI isn’t about static advantages; it’s about relentless execution. Without this velocity, startups risk being outpaced by newer applications or better-funded competitors in an industry defined by rapid evolution.

Compounding these challenges is the increasing pressure from incumbents in “Big Tech,” who are no longer stagnating but aggressively integrating AI into their product lines through internal R&D and acquisitions. Initiatives such as Google’s DeepMind and Microsoft’s Copilot are setting new benchmarks, making it increasingly difficult for early-stage startups to maintain a durable competitive edge. As part of our thesis, we closely evaluate whether a team has the capacity to outmaneuver Big Tech or position themselves as complementary players, rather than being overshadowed by these incumbents.

In the regional landscape, one of the most frequently cited moats for AI startups is their access to large datasets, particularly those focused on Arabic. With five major dialects and up to 100 regional variations, this localized data offers exciting opportunities for specialization. However, we believe this advantage, while valuable, is not inherently unique or defensible on its own. Instead, it can be leveraged as part of a “coopetition” strategy, (see part 2) collaborating with Big Tech to enhance their models while building complementary, differentiated offerings that serve niche regional or linguistic needs. This approach allows startups to capitalize on their strengths while mitigating the risk of being eclipsed by larger players.

Our approach is to avoid the hype and back founders with pragmatic roadmaps, leaders who understand that true product-market fit and durable growth require more than fleeting short-term adoption. We prioritize companies that focus on defensibility through unique data assets, strong customer relationships, and differentiated capabilities, ensuring they can withstand inevitable churn and competition. By aligning with fundamentals and supporting companies built on sustainable foundations, we believe our portfolio will be well-positioned to deliver meaningful impact and long-term value in this rapidly evolving space.

2. Highly Paid Professionals and the Automation of ‘Middle Tasks’

We’re particularly excited about GenAI’s potential to transform professions where experts rely heavily on pattern recognition and domain-specific knowledge.

Lawyers, consultants, finance professionals and diagnostic specialists, for instance, often spend years training to interpret complex information, while delegating “middle tasks” like drafting documents, synthesizing research, or writing reports to support teams. Goldman Sachs’s CEO, David Solomon, recently stated that AI can now draft 95% of an S1 prospectus in minutes versus a job that previously required a six-person team multiple weeks. The key takeaway here is that the remaining 5% still exists, where one finance professional (versus the previous six) can validate and refine the final output.

With GenAI, these middle tasks can be automated, allowing professionals to focus on higher-level decision making. The technology can learn from extensive historical data, surfacing real-time insights at a scale that outstrips any single individual. This reduces costs, shortens timelines, and often improves quality, making way for new service models.

3. Service as a Software: A Next-Generation Delivery Model

The rise of “Service as a Software” (SaaS²) represents a fundamental shift beyond traditional Software as a Service (SaaS) models.

While SaaS transformed software delivery through cloud-based subscriptions, SaaS² reinvents complex professional services as intelligent software systems that can operate autonomously at scale. Consider a financial advisory platform that continuously analyzes thousands of small businesses’ cash flows, automatically generates working capital recommendations, optimizes tax positions, and flags unusual patterns – all while integrating seamlessly with local payment systems and accounting software. These systems encode professional expertise and judgment into combinations of domain-specific algorithms and machine learning models, handling complex tasks that traditionally required significant human intervention.

The economics of SaaS² create unprecedented possibilities for service delivery. Unlike traditional services where scaling requires proportional increases in human capital, SaaS² platforms can expand through computational resources alone, with marginal costs approaching zero. What makes this transformative is not just automation, but the ability to deliver sophisticated services to previously underserved segments. Rather than a single financial advisor limited to 50-100 wealthy clients, a SaaS² platform can serve thousands of small businesses simultaneously with personalized analysis and recommendations, charging fees that would be uneconomical in a human-delivered model. While successful implementation requires careful consideration of domain suitability, quality assurance, and scope definition, the result is service delivery that’s infinitely more scalable, consistent, and accessible.

4. Reimagining the User Experience: From Clicks to Prompts

We see significant advancements where AI enhances user experience (UX). Generative AI can transform static dashboards and menu-driven interfaces into natural language-driven systems that analyze data, generate insights, and automate actions.

This aligns with the “three-click rule”, which states that every additional user action increases drop-off rates. The same applies to enterprise software: when users must navigate endless menus, engagement declines. AI-first solutions eliminate this friction, driving usability and adoption. A strong example is Pigment, a French enterprise planning and business intelligence platform.

In the GCC, the digitization gap remains stark. Many organizations still rely on Excel for critical processes or use horizontal ERP platforms that don’t meet their needs. AI-first solutions offer a chance to bypass outdated workflows entirely. Adoption is especially promising where AI can handle complex tasks, such as customer service automation or inventory management, without clunky interfaces. We are also entering an era of unbundling, where consolidated platforms are being replaced by specialized applications, especially in hospitality and F&B, where AI enhances operations, and in the office of the CFO, where it improves financial processes.

The region’s digitized government databases further accelerate this shift. With the UAE’s mandatory e-invoicing launching on July 1, 2026, businesses will gain access to structured data that enables AI-driven efficiency and better decision-making.

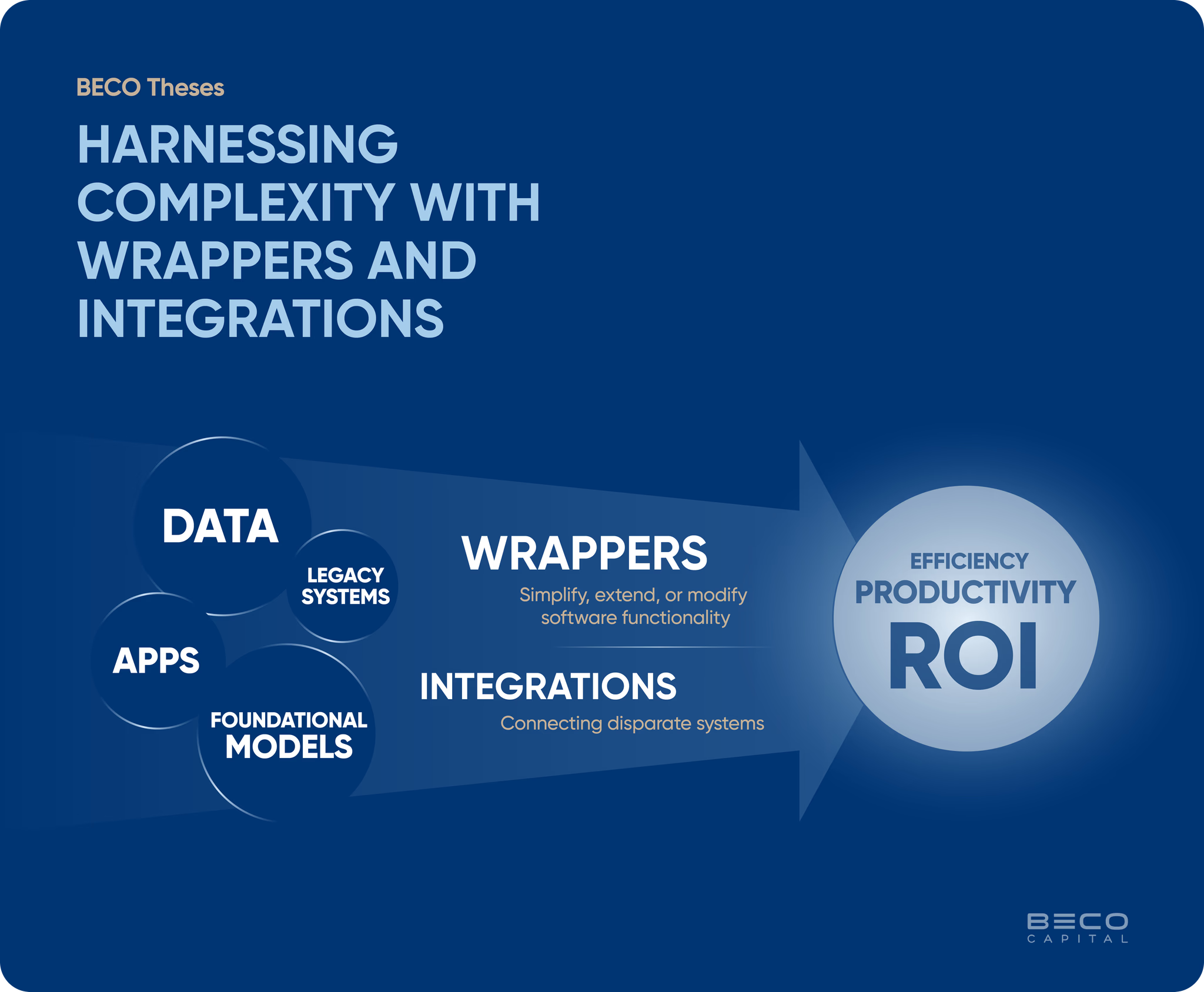

5. Bridging Complexity and Connectivity: The Transformative Role of Wrappers and Integrations in AI

Wrappers and integrations are transformative concepts in the AI era, serving as critical bridges between complex systems and user-friendly functionality.

Wrappers have historically acted as intermediary layers designed to simplify, extend, or modify software functionality without altering its core. They reduce complexity for developers and users alike, enhancing modularity, reusability, and accessibility. Integrations, meanwhile, address the challenge of interoperability by connecting disparate systems to enable seamless data flows and workflows. Together, these approaches play a vital role in making advanced technologies operationally viable, particularly in enterprises dealing with fragmented and siloed infrastructure.

The rise of generative AI and the proliferation of foundational models have brought renewed attention to the value of wrappers and integrations. AI systems are inherently complex, and wrappers abstract this complexity, making them accessible and practical for a broader range of users. As organizations increasingly adopt multiple AI models for specialized tasks, wrappers enable multi-agent orchestration, allowing seamless collaboration between models to automate workflows without users needing to manage intricate technical details. Simultaneously, integrations ensure these AI systems interact effectively with existing enterprise software like Salesforce, SAP, and ServiceNow, unlocking siloed data and generating unified, actionable insights that drive meaningful business outcomes.

It is often said that building wrappers is not worthwhile, but the AI age is proving otherwise. Companies like Cursor.ai, which scaled from $1 million to $100 million in ARR in just one year (making it the fastest ever company to do so), demonstrate the potential of wrappers to unlock significant value. This is particularly relevant in the GCC, where businesses are rapidly digitizing but often rely on legacy systems ill-equipped to handle modern demands. Wrappers and integrations offer these organizations a pathway to leapfrog incremental improvements, enabling them to adopt cutting-edge AI capabilities without needing to overhaul their entire infrastructure. For example, startups specializing in wrapping AI around specific use cases, such as automating invoicing or streamlining customer service, can deliver immediate ROI. Similarly, companies building integration platforms that unify siloed data sources into cohesive workflows can fundamentally improve the operational landscape of enterprises in the region.

The urgency of regional digitization initiatives amplifies the opportunity for wrappers and integrations. Governments in the GCC are driving progress through mandates such as the UAE’s upcoming e-invoicing system, creating fertile ground for startups to develop innovative solutions for these emerging needs. However, the rapid integration of AI capabilities by large incumbents like Salesforce and Microsoft narrows the window for startups to gain traction. This underscores the need for agile and focused solutions that deliver clear and measurable value, allowing startups to carve out defensible niches despite the growing competition.

In this environment, wrappers and integrations are more than tools, they are enablers of the next wave of AI adoption. Wrappers simplify and enhance the usability of advanced systems, while integrations ensure connectivity and interoperability across complex enterprise ecosystems. Together, they unlock the full potential of generative and agentic AI by bridging the gap between technical complexity and practical application. Startups that innovate in these areas have the potential to reshape industries, particularly in markets like the GCC, where a combination of fragmentation and rapid digital transformation creates ideal conditions for growth. By focusing on usability, scalability, and ROI, these companies can build enduring value in a dynamic and rapidly evolving technological landscape.

5.1 New-Age GenAI Consultants

An emerging offshoot within AI is the “GenAI consultant”, experts who help SMBs navigate the overwhelming landscape of AI tools, fine-tuning and integrating them into existing workflows.

With the breakneck pace of AI innovation and the continuous release of new applications, even tech-savvy organizations struggle to stay up to date. This challenge is not just about budget constraints; it’s a talent gap. Very few professionals possess the expertise to track and master every relevant GenAI application that can meaningfully transform business operations.

This creates a compelling opportunity for well-structured consulting practices to step in, leveraging GenAI’s efficiency to bridge the gap. A 10-person consultancy powered by AI could achieve the output of a 50-person team, automating workflows and unlocking new efficiencies that were previously unimaginable.

Additionally, the rise of domain-specific multimodal models, as opposed to purely general-purpose ones, enables more tailored workflows and deeper sector-specific insights. Just a year ago, digital GenAI transformations were constrained by high costs and limited customer interest. Today, we’re seeing the perfect storm: customer readiness, world-class GenAI applications, and rapid innovation have converged; making AI adoption faster, easier, and more compelling than ever.

This trend is already taking shape with sub-verticalized consultants specializing in specific AI products. A great example is Clay, an exciting company that has sparked the creation of 90 boutique consultancies, each focused on teaching clients how to maximize Clay’s capabilities. Now, envision a future where dozens of GenAI tools are consolidated under one roof, offering businesses seamless, end-to-end AI integration with hands-on support across industries. The potential for scalable impact is immense.

5.2. Reinvention of Managed Service Providers

An interesting offshoot of AI’s evolution is the revitalization of Managed Service Providers (MSPs). Historically, MSPs were perceived as slow-moving third party vendors that primarily managed IT and cybersecurity systems for customers.

However, with the rise of SaaS² and the ability to rapidly develop in-house applications, MSPs can now layer AI-powered solutions and create customizable wrappers that enhance their service offerings. This shift positions MSPs as more than just IT service providers, they are evolving into AI-native enablers capable of building, managing, and selling sophisticated AI-powered applications.

Much like the rise of next-gen GenAI consultants, MSPs are undergoing a fundamental transformation, not just in their value proposition, but also in how the market perceives their role. The space is being redefined, making it a compelling area to watch.

6. Debt Collection in the GCC

Debt collection has long been a critical – yet challenging – aspect of the financial ecosystem, particularly in the Middle East.

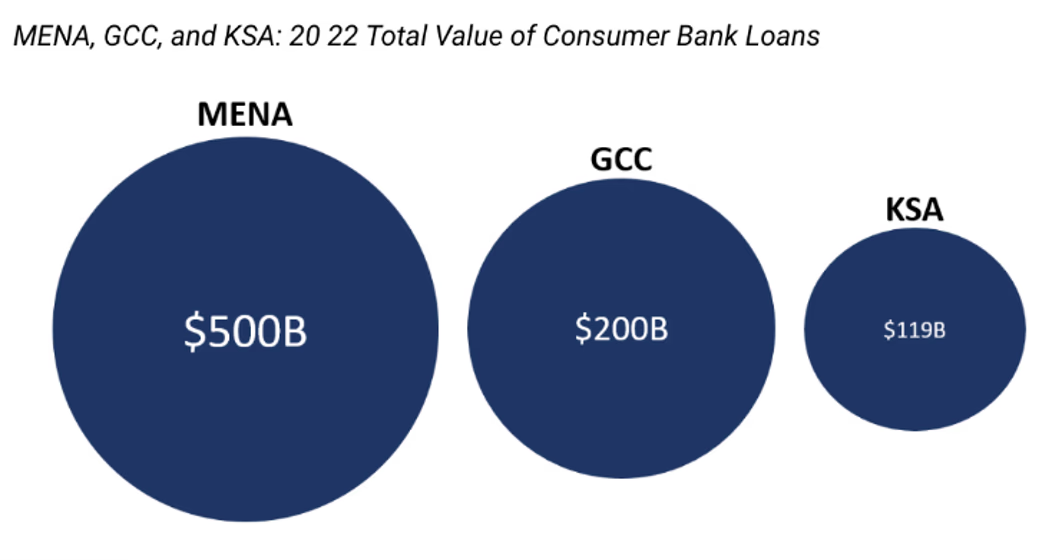

Traditional debt collection processes are often labor-intensive, relying on manual efforts and outdated communication methods, leading to high operational costs and a lack of scalability. Furthermore, these traditional approaches tend to focus on aggressive and intrusive tactics, damaging customer relationships and driving away potential future business. The unique cultural and regulatory landscape of the Middle East has only compounded these issues, as traditional collection agencies struggle to adapt and innovate within this context. As interest rates trend upward, non-performing loan (NPL) ratios are expected to rise even in the GCC’s relatively stable markets. Despite relatively low NPL ratios in key markets like the UAE (7%) and Saudi Arabia (2%), these figures are expected to rise as interest rates increase. This trend, coupled with the region’s growing consumer loan market (shown in the diagram below), creates an attractive landscape for digital-first debt collection services that are underpinned by AI.

source: CEIC data

We see a gap for digital-first AI solutions that handle outreach more strategically than legacy providers. The opportunity to act as a technology layer that stitches up numerous third party AI apps and packages them under one umbrella (akin to our earlier commentary on an AI wrapper) is an excellent way to tackle this problem. Companies like ClearGrid – a BECO portfolio company – illustrate how data-driven, automated engagement strategies can improve collection rates where traditional methods stall.

7. The Emerging Economy of AI Agents + The Importance of Domain Expertise

AI agents are rapidly becoming indispensable in automating workflows and enhancing decision-making, yet their presence remains largely invisible, operating silently behind the scenes.

Often likened to virtual employees, these agents handle specialized tasks ranging from customer support to financial analysis. Just as human employees differ in skills, productivity, and adaptability, AI agents, too, vary in performance, intelligence, and versatility. This raises compelling questions: If agents are virtual workers, shouldn’t some be more valuable than others? Could they be ranked, optimized, or even capitalized on as digital assets? And how are these agents governed, what happens if an agent makes a critical error or misstep?

To understand how we arrived at this inflection point, it’s worth revisiting the evolution of agentic AI. The journey arguably began in 2005 with the founding of UiPath, which introduced workflow automation software and eventually pioneered the category of Robotic Process Automation (RPA). Over time, RPA evolved by incorporating successive layers of intelligence, shifting static automation into something far more dynamic. Enter the era of agentic AI, enabled by a confluence of advancements: purpose built GPUs, the rise of LLMs, and, most critically, the advent of multimodal models. These innovations have unlocked the potential for agents to go beyond executing predefined workflows to emulating user logic and decision making. For example, Anthropic’s Computer Use or OpenAI’s upcoming Operator agent, slated for release in early 2025, exemplify this shift. These agents don’t merely follow tasks; they break them into subtasks, access the necessary applications and databases, and synthesize outputs tailored to user needs, bypassing the technical constraints traditionally limiting automation.

The implications of this evolution are profound. When agents are augmented with domain-specific LLMs that are trained on proprietary datasets, their capabilities become both specialized and highly effective. This specialization enables agents to deliver results with unparalleled precision, outperforming general purpose solutions in targeted applications. Whether optimizing logistics, managing financial operations, or enhancing customer service, such agents can fundamentally redefine how businesses operate.

This leads to an exciting thesis: AI agents are inherently modular and diverse, allowing for differentiation based on their capabilities and outputs. Agents that excel in specific workflows, due to specialization, efficiency, or cost effectiveness, can become premium digital products. This opens the door to a new economic model where agents are treated as on-demand services, accessible via marketplaces, direct licensing, or API monetization. Such ecosystems could include mechanisms for ranking agents by performance, facilitating transparency and trust while enabling organizations to choose the best-fit solutions for their needs. By commercializing agents, we transition from viewing them as invisible tools to recognizing them as measurable contributors of economic value.

This thesis is closely intertwined with the growing emphasis on domain-specific LLMs versus general-purpose ones. Specialized LLMs underpin the most effective agents because they are trained with a focused dataset, allowing them to master the nuances of a specific industry or function. This vertical focus makes them indispensable in contexts where precision and expertise are non-negotiable, reinforcing the need to invest in specialized AI infrastructure.

Ultimately, agentic AI and domain-specific LLMs herald a new era where AI systems don’t just assist users but emulate and enhance their logic and actions. The potential for AI agents to evolve into digital assets that drive measurable economic value is immense, creating opportunities for innovation, monetization, and the redefinition of workflows across industries. By focusing on specialization and modularity, this new economy of AI agents could become one of the most transformative aspects of the AI revolution.

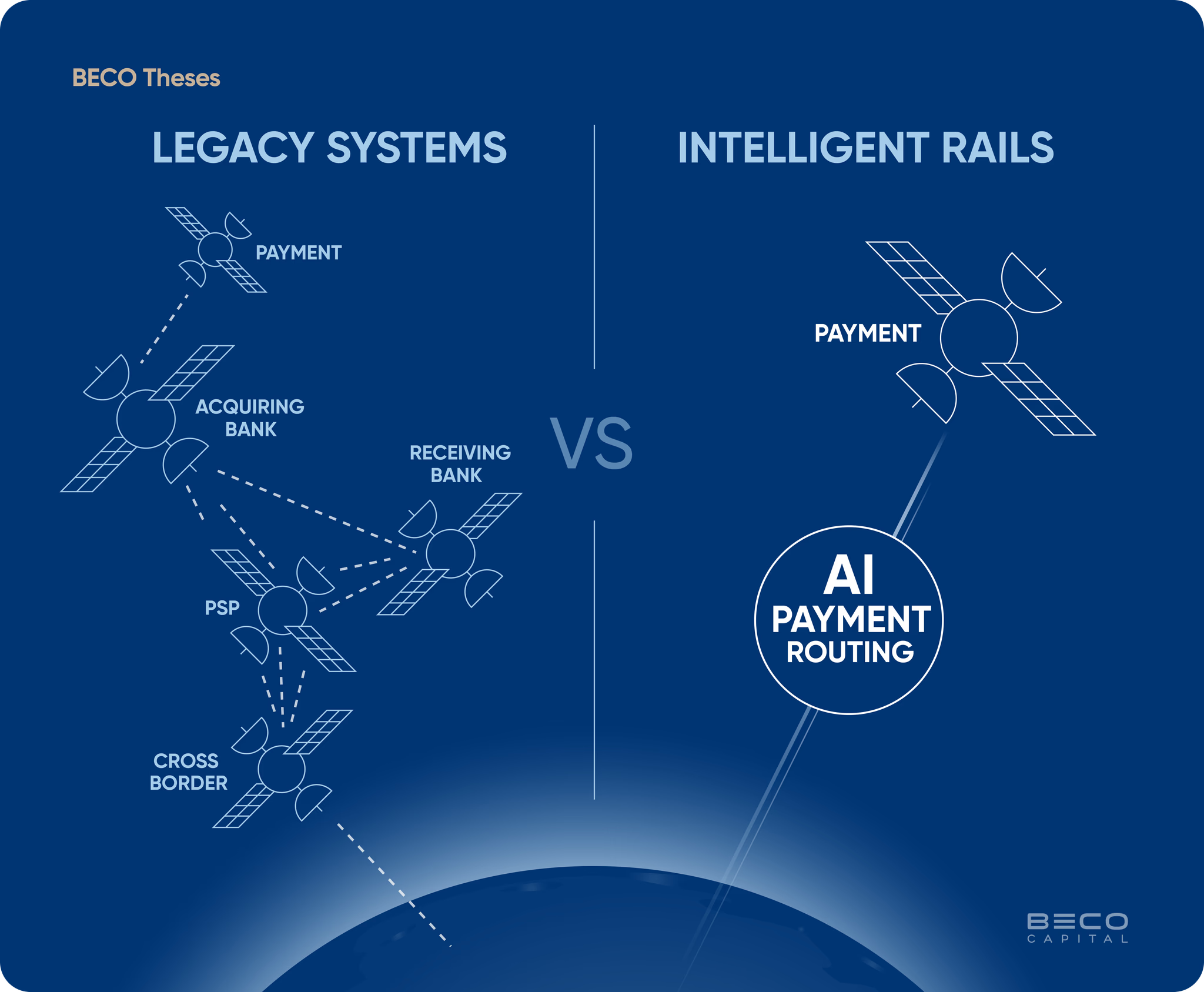

8. Agent-to-Agent Payment Rails

In the MENA region, the financial landscape is characterized by fragmented payment systems, diverse regulatory frameworks, and rapidly evolving alternative payment methods.

AI-driven agent-to-agent payment rails, where autonomous AI systems facilitate transactions between devices, platforms, or entities, are uniquely positioned to thrive in this environment. This would involve dynamic payment routing where AI (through agents) can analyze real time payment traffic and route transactions via the most cost efficient and reliable networks, such as deciding between SWIFT, blockchain rails or local payment networks.

Fragmented Payment Infrastructure: The coexistence of global systems like Visa and Mastercard with local schemes like Mada (Saudi Arabia) and Meeza (Egypt), alongside the rise of digital wallets and buy-now-pay-later (BNPL) platforms, creates complexity. AI can act as an intermediary, seamlessly connecting these systems to enable frictionless transactions

Cross-Border Payments: Given the high volume of cross-border trade and remittances in the region, AI-powered systems can optimize processes by handling currency conversions (either through fx or stablecoins such as the digital dirham), compliance checks, and transaction routing autonomously and in real-time.

Regulatory Momentum: Governments across the GCC are actively pushing for innovation in payments as part of broader economic reforms (e.g., Saudi Vision 2030). This creates a fertile ground for AI to redefine payment ecosystems, especially as financial institutions seek scalable solutions to meet these goals.

By addressing the specific challenges of fragmented systems and diverse payment behaviors, AI-enabled payment rails can deliver efficiency, inclusivity, and scalability, making them critical to MENA’s economic transformation.

9. AI-Driven Retail Optimization & Personalization

In a region where omnichannel retail is not just a preference but a necessity, AI-powered hyper-personalization has shifted from being an advantage to an imperative.

Traditional predictive analytics have long shaped retail strategies, but the next frontier lies in seamlessly integrating AI across both offline and online ecosystems to create a truly connected customer experience.

For example, our portfolio company Kitopi is pioneering the first fully connected hospitality ecosystem, where customer preferences, ranging from eating habits to dietary restrictions, are consolidated and reflected across all touchpoints, whether ordering online or dining at one of their 200 physical locations across 70 brands. Real-time access to these insights empowers waitstaff to enhance customer experiences while reducing inefficiencies as companies scale. Similarly, our portfolio company Dtek is revolutionizing convenience store operations by optimizing throughput capabilities with an AI-powered self-checkout system. Leveraging computer vision, this technology eliminates queue times, significantly enhancing the customer experience. On the back-end, AI is also transforming retail operations. Portfolio companies like Supy are leveraging AI to optimize inventory management in the F&B industry, improving stock accuracy, minimizing food wastage, and driving operational efficiencies at scale.

Beyond operational improvements, AI plays a crucial role in navigating the region’s cultural and behavioral complexities. MENA’s rich diversity means that consumer habits are shaped by language, tradition, and seasonality. For instance, Arabic dialects vary significantly across markets, requiring AI to hyper-localize customer interactions, from tailored product recommendations to language-specific marketing. This contextual intelligence extends to the retail calendar as well. Holidays like Ramadan, Eid, and National Days drive significant shifts in shopping patterns, but their impact differs by country, tradition, and timing. AI enables retailers to dynamically adjust pricing, promotions, and inventory to align with evolving consumer demand, whether it’s optimizing supply chains for pre-Ramadan stockpiling or adjusting marketing strategies to reflect the cultural nuances of different celebrations. From customer engagement to inventory optimization, AI-driven personalization is redefining how retail operates in MENA, elevating both customer experience and business efficiency and we are excited about pure-play companies focusing on elevating the retail experience.

Areas To Monitor

-

Arabic Language Solutions: A Complex Market

-

Project Management & Code Assistants

Another area with enormous promise is software development and project management. Companies like GitHub (Copilot) and GitLab, alongside new entrants like Augment, are pouring resources into AI-based solutions to automate code reviews, testing, and project triaging. Even Amazon, through its internal AI assistant “Q,” reportedly saved 4,500 developer years of work, translating to hundreds of millions of dollars in cost savings.

While these statistics are eye-opening, the competition is fierce. We find it challenging to pick a clear winner without seeing concrete defensibility, be it proprietary data, exclusive partnerships, or a unique user base that ensures stickiness over time.

A final piece of our AI thesis concerns Arabic-language products, particularly speech-to-text and text-to-speech. The potential audience stretches across hundreds of millions of speakers, but reported TAM figures can be misleading. Dialect fragmentation complicates any attempt at a “one-size-fits-all” approach, and enterprise budgets for advanced NLP features may be smaller than anticipated. Meanwhile, global AI players (Google, Meta, DeepL etc.) are also launching Arabic models and product features, quickly crowding the space.

For these reasons, we’re cautious. While we remain committed to exploring AI that genuinely solves regional needs, we need to see clear evidence of scalability and stickiness before making an early-stage bet in Arabic-specific voice or NLP. Simply put, the upfront R&D and marketing effort needs to align with realistic revenue potential.

Looking Ahead

While the AI landscape presents notable opportunities and challenges, BECO Capital maintains a conviction for the transformative potential of AI in the region.

Our thesis focuses on backing founders who combine technical excellence with pragmatic business models; particularly those leveraging the region’s unique advantages, while solving meaningful problems.

What We Look for in Founders Building in AI

To build enduring AI-first companies, we look for founders who demonstrate:

Experienced, Technical Leadership: Ideally, a team with prior experience building and shipping products, coupled with a deep understanding of modern, AI-first tech stacks and product development.

Original Thinking & Strategic Insight: A unique, first-principles approach to strategy, combined with rapid execution capabilities, to build a resilient business and continuously adapt to the evolving tooling landscape.

Extreme Execution Efficiency: Whether led by seasoned or first-time founders, the best teams achieve outsized impact with minimal resources, accomplishing what would typically require a much larger team and more funding.

AI-Driven Internal Leverage: Execution is enhanced by strategic AI integration, significantly improving team efficiency compared to traditionally tech-enabled approaches.

Unparalleled Speed of Iteration: A fast, measurable, and demonstrable rollout process that operates at an edge-case level, making it difficult for even great teams to iterate at the same speed. This combination of strategy and execution creates defensibility.

AI-First Go-to-Market (GTM) Approach: Teams leverage AI-native GTM strategies (e.g., using tools like Clay) to drive world-class Net Revenue Retention (NRR) and rapid payback periods.

Depth & Strategic Alignment: Every team member has domain depth and a clear understanding of why they are building in a specific way, ensuring alignment with the company’s overall strategy.

Compounding Network Effects: Whether through multi-AI agent coordination under the hood or proprietary data generation, the best teams build self-reinforcing moats that compound over time.

As we navigate this rapidly evolving and fascinating landscape, our investment approach remains grounded in identifying capital efficient opportunities where we can help validate products locally before scaling globally. The convergence of government initiatives, digital transformation, and regional market dynamics creates a unique moment for AI innovation in MENA. By maintaining our disciplined investment approach while staying responsive to market developments, we are poised to support the next generation of ambitious AI companies in the region.